Can You Withdraw Money From Your Savings Account With Chime

The majority of Americans have a bank account. For those who don't, and even for those who have one but still use alternative financial services such as payday loans and check cashing businesses, using such services can cost them more in transaction fees and make banking a hassle.

Bad credit and past mistakes in handling a bank account at traditional banks or online banks can lead to banks barring these potential customers from opening a new account for up to five years. The Federal Reserve reports that 6% of people are unbanked and 16% are underbanked.

The mobile banking app Chime aims to solve this problem by helping people who can't get a bank account or don't want one. It doesn't check if an applicant has bad credit. Instead, it offers them and anyone else a chance to open checking and savings accounts with no fees.

Chime just isn't for people who can't open a bank account elsewhere. Even if you have good credit and have been with your bank for years, Chime's interest rates, free overdrafts, no hidden fees and other benefits may be enough to convince you to do your banking with it.

- What is Chime?

- How does Chime work?

- No credit check

- How to deposit money

- How to withdraw money

- How much does Chime cost?

- Chime's features

- Chime Spending

- Savings Account

- No overdraft fees

- No hidden fees

- Mobile banking

- Automatic savings

- Mobile payments

- Who is Chime best for?

- You want free banking

- You're OK with mobile-only banking

- You have direct deposit at work

- You overdraft occasionally

- Who shouldn't use Chime?

- You prefer physical bank branches

- You deposit cash often

- Chime pros and cons

- Chime vs. competitors

- Chime vs. Chase

- Chime vs. Bank of America

- FAQs

- The bottom line

What is Chime?

Founded in 2013 in San Francisco as an alternative to traditional banking, Chime offers fee-free financial services through a mobile app for iOS and Android, and through its website. It has no physical branches.

Account-holders are issued a Visa debit card, whose use helps Chime collect most of its revenue. It is paid an interchange fee when the card is used to buy something.

The basic account Chime offers is a checking account called Chime Spending Account, which comes with a debit card. It has an early direct deposit feature that allows users to get money from their employer up to two days early.

Chime also offers a savings account called High Yield Chime Savings Account. It currently pays an Annual Percentage Yield, or APY, of 0.50%.

Neither account has a minimum balance requirement. Chime accounts are insured by the FDIC for deposits of up to $250,000.

How does Chime work?

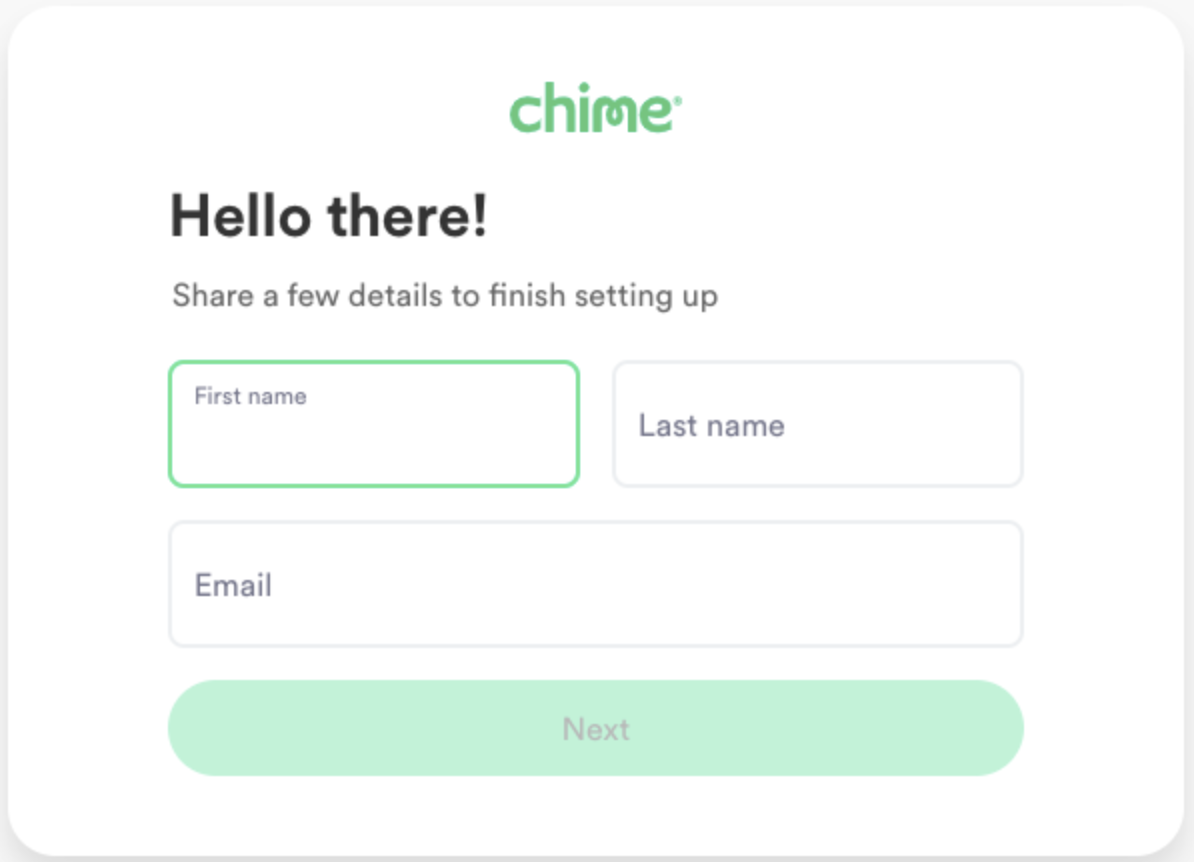

Opening a Chime account online is easy. Start by clicking on the green button at the top, right area of a web page, which should read "Get Started" or "Open an Account," depending on which page you're on.

From there you'll be asked to fill out eight short online forms that will appear individually as you click through the process.

The first is simple enough, asking for your name and email address.

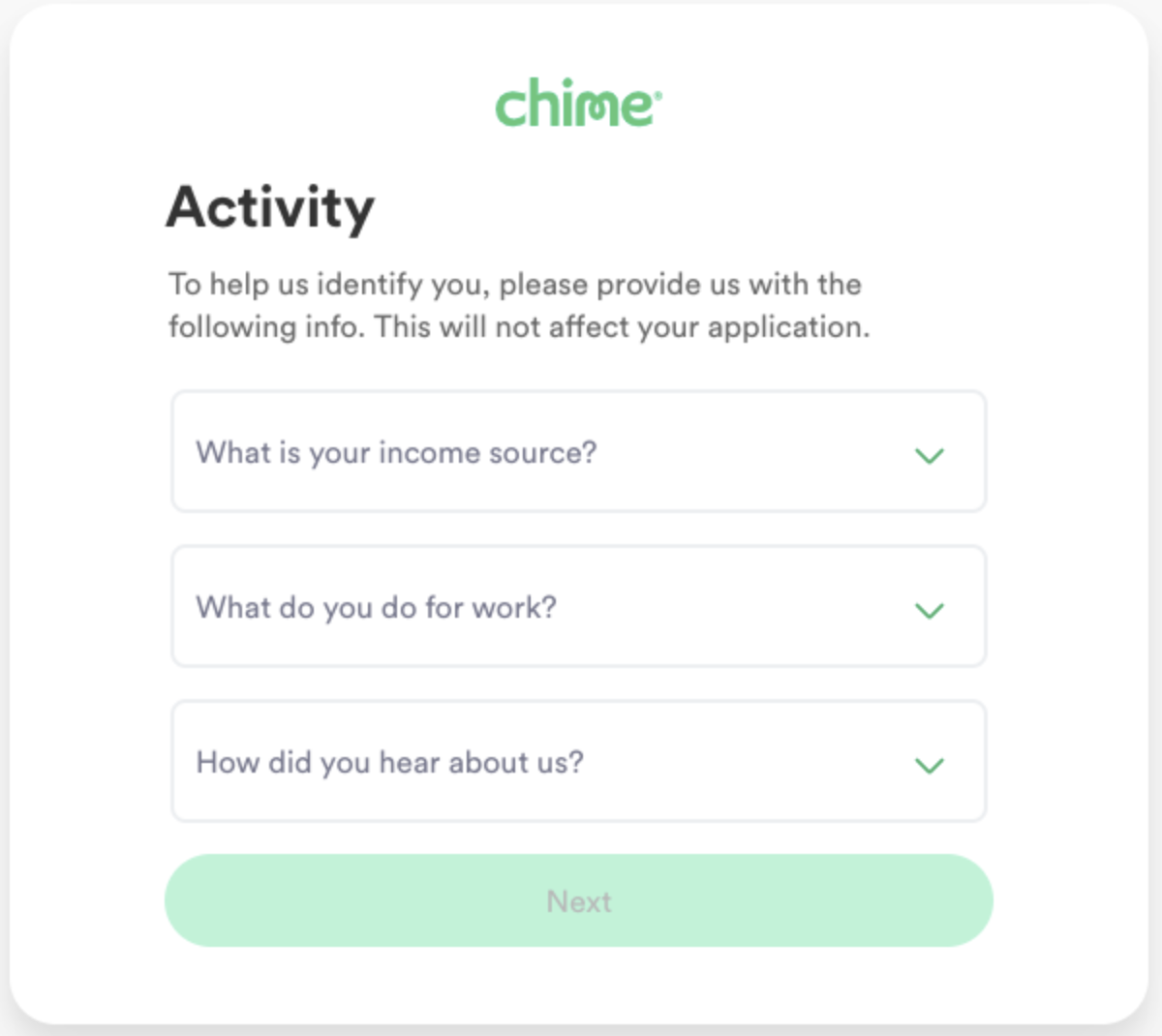

Then separate prompts will ask for your:

- Date of birth

- Mobile phone number

- Home address

- Password that you create

- Social Security number

- Income source

- Job title

- Annual income

- How you're paid

- How you heard about Chime

The information is used to identify you and won't affect your application, Chime says.

The final step is checking two boxes agreeing to the user agreements, and then your application is submitted. The whole process should take less than two minutes.

No credit check

What Chime doesn't do is check your credit history for your credit score. It offers what it calls "second chance banking."

The banking industry has its own form of credit reporting called ChexSystems. It isn't a credit bureau like the ones that check if you haven't paid your credit card bill in months but is a database of closed checking and savings accounts. If you have bad marks on your ChexSystems report, you could be barred from opening new accounts for up to five years.

Chime says it doesn't use those reports.

How to deposit money

Chime doesn't have physical bank offices, so depositing money isn't as easy as visiting your local bank.

Instead, Chime has a few ways to deposit money:

- Direct deposit from your employer's payroll provider

- Transfer from a linked external bank account

- Mobile deposit of a paper check

- Cash deposit at more than 90,000 retailers

- Chime's debit card can be used at 38,000 free ATMs across the country through the MoneyPass and Visa Plus Alliance networks

However, as Chime points out, the ATMs it works with don't accept deposits of any kind.

Instead, cash can be deposited at retailers such as Walmart, Walgreens, CVS, Rite Aid, Family Dollar, Dollar General, Circle K, and 7-Eleven. Tell the cashier you want to deposit money to your Chime account at the register, which they'll enter as a "cash reload."

Up to three deposits can be made every 24 hours, up to $1,000 daily and $10,000 monthly.

Some third-party money transfer services such as these may impose their own fees or limit how often you can deposit cash, Chime warns.

How to withdraw money

Chime doesn't have its own ATMs where customers can withdraw cash, but uses 38,000 fee-free ATMs in the MoneyPass and Visa Alliance networks. The app has an ATM finder to find a free ATM at businesses such as Walmart, CVS, Target, and grocery chains such s Whole Foods, Trader Joe's, and Safeway.

Up to $500 can be withdrawn per day at any ATM. If you make a withdrawal outside of its networks, you'll be charged a $2.50 fee, and the ATM provider may charge an additional fee.

Cash can also be withdrawn by going into a bank or credit union and giving your Chime Visa debit card to a teller. This is an over-the-counter withdrawal and costs $2.50 per withdrawal, and is limited to $500 daily, just like at a non-network ATM.

Cash withdrawals can only be from Chime Spending Accounts, and not from its Savings Account. To pull money out of a savings account, you must first transfer it to your Spending Account.

How much does Chime cost?

Before we get to the shortlist of fees that Chime charges, here's a list of the fees it doesn't charge:

- No monthly account maintenance fee

- $0 minimum balance

- Free access to 38,000 in-network ATMs

- No foreign transaction fees

- No overdraft charges

Chime does charge one fee: $2.50 for withdrawing cash from an out-of-network ATM or an over-the-counter withdrawal at a bank or credit union.

That's it. It claims it has no hidden fees, and from what we've found, it's legit.

Chime's features

Chime has two types of accounts, checking and savings. You must have a checking account before you can open a savings account with Chime.

Each account has its own features, though some overlap. Before we detail some of the many features Chime offers, here's a breakdown of what the checking and savings accounts have.

Chime Spending

This is the basic checking account at Chime. It comes with a Visa debit card that can be used anywhere in the world where Visa is accepted.

Here are some of the features of the Chime Spending account:

- No monthly account fees

- No minimum balance requirements

- Every time your debit card is swiped, Chime rounds up to the nearest dollar and transfers the round-up from your Spending Account to your Savings Account as a way of automatic savings

- Mobile app on iOS and Android that support mobile payment such as Apple Pay and Google Pay

- Fee-free overdrafts

- Mobile check deposit

- Free ATMs in its networks

- Free mobile check deposit of paper checks if you have a payroll direct deposit of more than $200 per month

- Free debit card replacement

- Direct deposits arrive two days early

Savings Account

The Chime Savings Account pays 0.50 APY. The interest rate is variable, meaning it can change monthly. The average national savings account interest rate is 0.05%, according to Chime.

Features of the Savings Account include:

- No minimum balance

- No fees

- Purchases on your Chime debit card will automatically be round up to the nearest dollar and the extra change is transferred from your Spending Account into your Savings Account

- Automatically transfer part of your paycheck into your Savings Account

- Money can't be directly deposited into a Savings Account, but can be transferred directly from your Spending Account

- Early payday

- Paycheck up to 2 days early

Setting up direct deposit is easy. When you open a bank account through Chime, it emails you a pre-filled direct deposit form that you can give to your employer.

No overdraft fees

Chime doesn't charge overdraft fees on debit card purchases up to $100 and won't leave you with a negative balance. Money used to cover the overdraft debit charge is repaid to Chime at your next direct deposit.

Members qualify for what it calls the SpotMe service by having total monthly direct deposits of $500 or more. Chime accepts optional tips for providing the service.

SpotMe doesn't cover ATM withdrawals, Pay Friends transfers, checkbook transactions, or transfers such as Venmo or Square Cash.

No hidden fees

As we detailed earlier, Chime prides itself on not charging fees that many banks and banking services do. These include no monthly fees, minimum balance fees, or overdraft fees.

It uses ATM networks with more than 38,000 fee-free ATMs. Using one outside of the networks costs $2.50 per transaction.

Mobile banking

Chime's mobile app works on iOS and Android devices. The app has more than 135,000 five star reviews in app stores, Chime says.

The app does everything from tracking your spending and savings to paying friends. You can transfer money, send and deposit checks, pay bills and grow your savings automatically.

The app can also be used to set real-time alerts so you know instantly when your Chime debit card is used.

Automatic savings

Automatic transfers can be set up from a Chime Spending Account to the Savings Account, including from every paycheck.

When using the Visa debit card tied to your Spending Account, purchases will be rounded up to the nearest dollar and the difference is transferred to your Savings Account. Pay $3.55 for a cup of coffee and $4 is withdrawn from your Spending Account and the 45 cents difference is sent to your Savings Account.

Mobile payments

With your Chime Visa debit card, you can make contactless payments from your phone through Apple Pay and Google Pay.

Chime also has a free mobile payment app called Pay Friends to instantly send money to anyone with a Chime Spending account. Money is deposited instantly and no fees are charged.

Who is Chime best for?

People who can't open a traditional bank account If you have bad credit or have made some banking mistakes that have prevented you from opening an account at a traditional bank, Chime will allow you to open checking and savings accounts.

Chime doesn't check credit reports or the ChexSystems database that many banks use to collect information on past clients. Some banks may not allow you to open an account for five years if you have bad marks in its database.

You want free banking

Other than the $2.50 fees for using out-of-network ATMs or going to a different bank to pull out your money, Chime doesn't charge any fees.

Overdrafts are free. There are no monthly maintenance fees for a checking or savings account. You can open an account with one penny.

If free banking is what you're looking for, Chime offers it in many ways.

You're OK with mobile-only banking

Chime doesn't have physical bank branches. It relies on its mobile app and website to help customers manage their money, and uses direct deposit and 38,000 fee-free ATMs to help them deposit and withdraw their cash.

If you don't need to go into a physical bank and don't mind scrolling on your phone to do your banking, Chime can work well for you.

You have direct deposit at work

Many banks have direct deposit from employers, but Chime gives you access to your money up to two days earlier than some traditional banks that have direct deposit.

This can mean paying your bills on time and having cash in your hand when you need it, instead of possibly waiting for a day or two after payday.

You overdraft occasionally

If you try to buy something with your Chime debit card and don't have enough money in your account, Chime will cover you up to $100. The money that you're spotted will be deducted from your account when your next direct deposit arrives.

Customers must have direct deposits of $500 or more each month to be eligible for this service.

Who shouldn't use Chime?

You prefer physical bank branches

Chime has no physical officers for customers. You'll have to use its phone app, in-network ATMs and deal with cashiers at some retailers to deposit and withdraw money.

If you use an ATM outside of its network you'll be charged a $2.50 fee. Some third-party fees may be charged when depositing cash.

You can go into a physical bank or credit union to withdraw or deposit cash for your Chime accounts, but that bank will charge you $2.50 for each transaction.

You deposit cash often

As we just mentioned, if you want to deposit cash, it could cost you money. Bank of America, Chase, and other banks and banking services will accept cash deposits, as will some retailers, but a $2.50 charge will be made each time.

Chime pros and cons

- 38,000 ATMs. Chime has more than 38,000 ATMs in two networks. All are in retail stores, so you may have to find a store that's open at the hour you want to withdraw money, but finding one near you shouldn't be difficult.

- No fees. Other than $2.50 fees for using out-of-network ATMs or going to another bank or credit union, Chime doesn't charge any fees. This includes no overdraft fees if you have direct deposit of $500 per month.

- Early direct deposit access. With direct deposit from your employer, Chime gives you access to this money up to two days before traditional banks do.

- No physical banks. Chime doesn't have any physical offices, so you won't be able to walk in talk with a teller or do other banking in person. You can deposit or withdraw cash at another bank with your Chime Visa debit card, but you'll be charged $2.50 per transaction.

- Depositing cash is difficult. Cash can't be deposited at the ATMs that Chime works with. Some retailers that work with Chime may allow deposits, though they may charge a fee.

- Transfer limits. Transferring money to Chime through an external bank is limited to $200 per day and $1,000 per month. You may be able to get around that by initiating the transfer at your external bank account, which may have higher limits.

Chime vs. competitors

| Bank | Monthly fee | Branches | ATMs | ATM fees | Minimum balance |

|---|---|---|---|---|---|

| Chime | $0 | 0 | 38,000 | $0 / $2.50 | $0 |

| Chase | $25 | 4,700 | 16,000 | $0 / $2.50 | $25 |

| Bank of America | $25 | 4,300 | 16,000 | $0 / $2.50 | $100 |

Note: Under ATM cost, the first figure is for in-house or in-network ATMs. The second is for using out-of-network ATMs.

Chime vs. Chase

The Chase Total Checking account is one of the biggest competitors to Chime, mainly because Chase is one of the biggest banks in the country.

A Chase checking account is free by meeting the simple requirement of depositing at least $500 each month. That's the same amount Chime requires through direct deposit to qualify for its free overdraft protection on debit card charges. Chase even pays new customers $200 to open a checking account with direct deposit.

For $500 in monthly deposits, you get access to Chase's 4,700 branches and 16,000 free ATMs. If you want to talk to a teller in person, you can.

Chime vs. Bank of America

Bank of America has just as many ATMs as Chase, and about 4,300 branches. It has three types of checking accounts, with the one called Advantage Plus costing $12 per month but the fee can be waived for having direct deposits of $250 per month.

But where Chime doesn't charge for overdrafts, Bank of America does, $12 for an overdraft protection transfer.

If you have more financial needs than basic checking and savings accounts, Bank of America or another large bank may serve you better than Chime.

FAQs

<faq question="How do I reach Chime?" answer="Not having a physical branch to visit can be a pain in the neck if you have an immediate concern about your Chime accounts. Chime customer service is available through its app or email. It is also available by phone on weekdays from 6 a.m. to 10 p.m. CST, and on weekends from 7 a.m. to 9 p.m. CST. Chime's phone number is listed on the bottom of its website, as is its social media channels. The website has a blog and FAQ section that may answer some of your questions, though you'll have to hunt to find some of them. It also has an online Help Center to answer basic questions.

How much do I need to open an account?

Technically, $.01 is enough money to transfer to open a checking account at Chime. After that, if you want free overdraft protection of up to $100, you'll need to have monthly direct deposits of $500.

Are there really no fees?

Yes, there are no fees at Chime. The only fee we could find, which Chime points out a few times, is $2.50 for using out-of-network ATMs or another bank to access your Chime accounts.

The bottom line

One of the best things we like about Chime is how it helps the unbanked open checking and savings accounts without having to pay fees to do their daily banking.

The Federal Reserve reports that 6% of people don't have bank accounts, which is called being unbanked.

It also found that 16% of people are underbanked, meaning they have a checking or savings account, but they still use alternative forms of banking such as payday loans and check cashing services to do their daily banking. Most of those services, if not all, often charge high fees that can make paying bills and getting cash expensive.

Chime helps consumers avoid these problems by not charging fees for using its ATMs, mobile app or even overdrawing on an account. And it doesn't hold bad credit or past banking mistakes against people who want to open accounts with it.

Even for those who can easily open a bank account elsewhere, Chime may be the best place to put their money for the simple fact that they won't pay fees for basic services.

Can You Withdraw Money From Your Savings Account With Chime

Source: https://joywallet.com/article/chime-banking-review/

Posted by: fischerporybouted.blogspot.com

0 Response to "Can You Withdraw Money From Your Savings Account With Chime"

Post a Comment